Aussie Dollar Tumbles on Surprise Rate Cut

???? Today’s Spotlight Market

With the Reserve Bank of Australia (“RBA”) lowering its benchmark interest rate to a record low 2.75%, we may see more volatility in the value of the “Aussie” Dollar vs. other major currencies, as trading activity has been rather quiet lately because prices have become range-bound.

Traders will not have much down time following the RBA rate cut as they await the release of some key economic data to be released later this week that may significantly affect the currency’s value. Among the key economic reports are Chinese balance of trade figures to be released on Wednesday, as well as Australian employment figures which will be announced on Thursday.

???? Fundamentals

The Reserve Bank of Australia (“RBA”) surprised many currency traders by cutting the policy rate by 25 basis points to a record low 2.75%. In addition to the rate cut, the RBA also gave guidance that it would not be opposed to lowering rates further if conditions warrant. A strong Dollar has hurt the country’s competitiveness in the export market, which has also suffered headwinds from slower growth prospects out of China, who is Australia’s leading trade partner.

Large speculators have used the Australian Dollar as the” long” currency in so called “carry trades”, where traders hope to profit by buying a currency of a country with a higher short-term interest rate and at the same time selling a currency of a country with a lower short-term interest rate, such as the Japanese Yen. By lowering interest rates, and especially by stating an easing bias, the RBA has made this trade less attractive.

This move out of the “Aussie” carry trade is evident in the AUD/JPY currency cross, which weakened by over 100 pips in the hours following the RBA announcement. Currency traders may wish to keep an eye on upcoming Australian economic data, as further weakness in these reports could signal a more aggressive move toward lower rates than the market anticipates.

???? Technical Notes

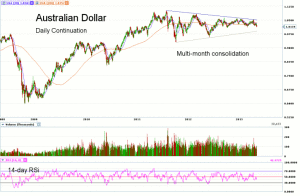

Looking at the daily continuation chart for Australian Dollar futures, we notice prices have been holding in a narrowing consolidation pattern going all the way back to the second half of 2011. The RBA’s interest rate cut could spur further long liquidation selling, and a test of the lower trendline of this chart pattern should not be discounted.

Prices are now trading below both the 20 and 200-day moving averages (“MA”), and momentum as measured by the 14-day RSI has turned lowe, with a current reading of 42.37. The March 4th “spike” low of 1.0104 is seen as near-term support, with longer-term support currently found near the 0.9900 price level. Near-term resistance is found at the 20-day MA, currently near the 1.0301 price level. Longer-term resistance is seen at the 200-day MA, currently near the 1.0357 area.

————————————————————————————–

Do you want to learn more about unusual options trading activity? Then the Unusual Options Activity Forum is for you:

When: Wednesday, May 15

Time:? 2:00 p.m.

Where: The Chicago Board Options Exchange, 400 South LaSalle Street, Chicago, IL 60605

Price: $99

What Will You Learn?

Attendees of this one-of-a-kind event will learn:

- The specific tools, strategies, and techniques used by options experts to identify unusual options trading activity

- How to filter out meaningful trades from the sea of noise in the options market

- How to successfully incorporate unusual activity information into your options trading

- How to avoid the costly mistakes made by many traders when analyzing unusual options activity.

What Will You Get?

- A Rare, Guided Tour of the Historic Chicago Board Options Exchange Trading Floor ? Including the Apple, Google, SPX & VIX Trading Pits (street price: unavailable to the public)

- One Free Month of Option Vision ? ?A unique 3-D charting platform designed to hunt down unusual options activity (street price: $99)

- One Free Month of OptionAlert ? The leading option flow monitor and unusual activity analysis tool (street price: $150)

- One Free Month of Livevol Pro ? The premiere analytics platform for professional options traders (street price: $199)

- Free Copy of The Options Traders? Hedge Fund (street price: $40)

- One Free Month of Option Pit Live ? Option Pit Live is designed to feed option traders the best actionable options trading content on the web. (street price: $125)

- One Free Month of Market Taker Group Coaching ? Let the pros at Market Taker Mentoring improve your options trading. Receive professional daily group mentoring sessions for one month ? including 20 trade ideas each session. (street price: $332)

———————————————————————————

Disclaimers

This article is provided for informational purposes only. No statement in this article should be construed as a recommendation to buy or sell a security or to provide investment advice. The content provided has been obtained from sources deemed reliable but is not guaranteed as to accuracy and completeness. optionsXpress makes every effort to provide timely information to its recipients but cannot guarantee specific delivery times due to factors beyond our control.

Derivatives involve substantial risk and are not appropriate for all investors. Please read the “”Disclosure Statement for Futures and Options”” prior to investing in futures or options.

For investments using a straddle or strangle options strategy the potential loss is unlimited. Multi-leg option strategies are subject to multiple commissions. Profits may be eroded by the commission expended to open and close the positions and other risks apply.