Buying In BlackBerry Call Options Triggered By Ford Auto Move

Monday is set to be the first day in February during which BlackBerry options will trade on volume in excess of 100,000 contracts. With its stock currently trading 8.5% higher at $9.93, options activity has gravitated towards bullish plays. One argument bolstering the stock price is that it is an unwitting beneficiary of Facebook?s recent purchase of WhatsApp? Last week. The social media giant paid $42 per user and the suggestion is that having determined it will maintain its BlackBerry Messaging system across all platforms, similar valuation could be applied to its army of loyal customers. However, the more likely catalyst is Ford?s decision to ditch its currently used in-car tech system from Microsoft for that of QNX Software Systems, which is owned by BlackBerry. That move announced by Ford over the weekend will kick off in 2016.

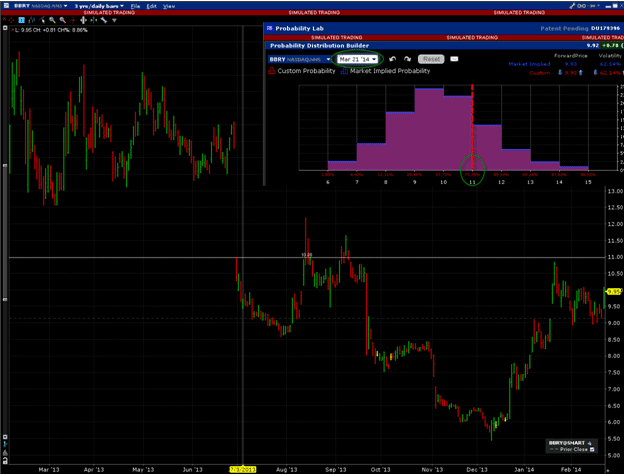

But buyers appear not to be left waiting to see what the impact might be. The chart below shows that shares in BlackBerry have not traded at $11.00 since September and that was before the stock fell to earth tumbling by half to touch below $5.50 in December. Now, however, those persistently bullish on the corporate revamp are looking for a return to $11.00 by March options expiration. Almost 20% of Monday?s options activity took place at the 11.0 strike where 17,000 contracts changed hands as the cost of the right to lock-in to the stock at that price doubled to 30-cents per contract. In the upper right of the chart you can see the Probability Distribution for the price by that time. Currently, the market is assigning just below a one-in-four likelihood that BlackBerry will settle above $11.00 at that time. While the day is not yet done, strong volume on its shares might suggest the sound of returning investors to BlackBerry. One would think that a test above $10.00 for its shares might provide a stronger base from which to build. And should that happen, the odds of a jump to $11.00 will surely shorten as options premiums continue to rise.

Chart ? BlackBerry options argue three-to-one against a close above $11.00 by March expiration

——————————————————————————————————–

Note: The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Interactive Brokers LLC nor its affiliates warrant its completeness, accuracy or adequacy and it should not be relied upon as such. Neither IB nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this information. Past performance is not necessarily indicative of future results.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities or other financial instruments mentioned in this material are not suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. The information contained herein does not constitute advice on the tax consequences of making any particular investment decision. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation to you of any particular securities, financial instruments or strategies. Before investing, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.