Here?s an interesting new paper from S&P Dow Jones Indices?about dispersion and why it is a more valuable estimate than correlation:

?[W]hat does it mean to say that a particular index (or portfolio) is diversified? Or more diversified than another, or more now than it was before? In order to speak meaningfully about the internal diversity of an index and its variation over time, quantitative metrics are required. The most commonly encountered is the correlation statistic, but correlations contain critical and unavoidable flaws. It turns out that another measure?asset dispersion?has strong qualifications as a complementary tool.?

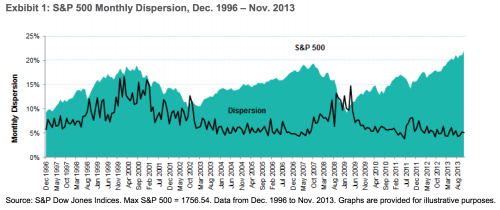

One of the key claims in the paper is that the dispersion of asset returns is a good way of measuring the value of stock selection strategies. That is, when dispersion is low, passive indexing can be expected to offer better risk-adjusted returns net of fees than active investing. The opposite would be true during periods of high dispersion.*

That?s worth thinking about the next time you hear an academic or a market pundit praising the virtues of simplistic, passive index funds over ?expensive? mutual funds, hedge funds, or self-directed active strategies. Post-recession returns have been characterized by low and declining dispersion, so it makes sense that passive indexers have done well, especially in 2013. How likely is it that we will see a low dispersion environment favorable to passive beta over the next five years? What if, just as the last working-age adult moves her equity allocation into some no-commission, 1 bps fee S&P 500 tracking fund, it starts to matter again which assets she?s invested in?

* In the paper, the authors show that, since 2003, the percent of outperforming actively managed large-cap core U.S. equity funds did not vary positively with dispersion. That point isn?t very satisfying, though, since: 1) n=1 here, that is, we?re really just looking at how funds fared during one regime shift (2007-2009); 2) those funds are mostly long-only, and since the dispersion increase was associated with downside volatility, that?s not as valuable a test as a high-dispersion rising market; 3) large cap U.S. equity is great, but presumably a good manager?s stock selection skills really shine when evaluating smaller companies.

Sign up for our new equity and ETF derivatives research publication,?Volatility Tracker.