The Commodity Futures Trading Commission (CFTC) has released a report since 1962 showing what positions were held by Speculators and Commercial traders.? This particular report named, Commitment of Traders Report (COT) and is also known as the Legacy version.? There have been numerous articles written about this report and how a trader can use it as an odds enhancer.

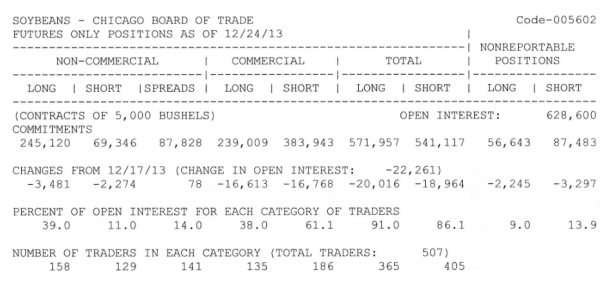

I would like to briefly review this Legacy version of the COT and also introduce the newest style COT report, the Disaggregated report.? Figure 1 is the Legacy report as it is released from the CFTC every Friday at 15:30 Eastern time (-5 GMT).? The data is reflecting the Open Interest as of Tuesday of each week, there is a 3 day lag.

Fig 1

The first thing you need to know about a COT report is what is it actually measuring?? Each day the Exchanges report to the public the previous days Open Interest for each Futures contract traded.? Open Interest is the number of contracts that have been entered into and not offset yet.? Anybody who holds Futures contracts overnight will have an impact on Open Interest, day traders do not because they are always flat their positions at the markets close each day.? Open Interest can be used to help identify when a trend may be coming to an end or possibly when one is about to begin.? Open Interest is usually plotted as a solid line that overlays a volume chart at the bottom of the chart.

But Open Interest can also be used to determine what the smart money in the markets is doing.? Each week the COT reports give a trader an inside look as to who?is in control of the markets ? Speculators or Commercials.? Looking at Fig 1 there is a box for Open Interest.? In this example we are looking at the Soybean market.? As of this report there are 628,600 open contracts.? What the COT report does is breaks down this Open Interest number into each category of traders. Notice the categories for the Legacy report, they are:

- Non-Commercial (Large Speculators)

- Commercial

- Non-Reportable?? (Small Speculators)

How does the CFTC know where to place the number of contracts for each trading entity?? To better regulate the Futures markets the Exchanges and the CFTC require all traders who have a certain number or higher of open positions in any one market to report to the CFTC.? For most of us this number will not be a problem so there is no need to worry about reporting to the CFTC.? Each market has a different reportable position size, but most are several hundred to thousands of open positions at once.

Since 1962 the Legacy report has looked like Fig 1.? In 2008 when Commodity markets were on fire and in a strong bull market the price of Crude Oil rallied to about $147 in the near month contract.? This price was an all time high for Crude Oil and obviously had an impact on world economies and caused consumers to stop spending money for non-discretionary products.? As one might expect there was a controversy over who caused this price rally in Crude Oil ? Speculators or Commercials?

When the government looked at the COT report to get this information the Legacy report did not show who caused this.? How could this be possible since each week all traders trading over a reportable position limit were required to report to the CFTC?? The problem lies in how the CFTC categorized the Commercial traders.

Years ago another group of traders emerged on the scene known as Swap Dealers.? These traders are normally always hedging their physical Commodity contracts (Over the Counter Products (OTC)) with the Futures markets.? These Swap Dealers could include companies like Barclays that issue shares of a Gold Exchange Traded Fund (ETF?S) and they hedge the sale of those shares in the Futures markets.? These Swap Dealers became categorized as Commercials because they were registered as Hedgers with the Futures Exchanges.? Swap Dealers and Commercial traders can be two totally different entities in the Futures markets.? When it came time to track down who was to blame for these high Commodity prices it was not apparent based on the COT Legacy report, because the Swap Dealers were clumped in with the Commercial traders.?

In 2009 the Government asked the CFTC to split up the Swap Dealers and the Commercials into their own separate reportable positions.? The debate goes on today whether ETF?s should be registered with the Exchanges as Commercial traders or not.

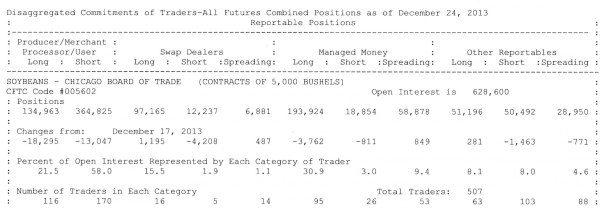

The report that has come out side by side with the Legacy report each week since 2009 is known as the Disaggregated report.? The CFTC is currently soliciting opinions about how helpful this newer report is and may someday discontinue the Legacy report.? Figure 2 shows the CFTC COT Disaggregated report.

Fig 2

The new categories for the Disaggregated report are:

- Producer/Merchant/Processor/User

- Swap Dealers

- Managed Money

- Other Reportables

The Non-Reportable (Small Speculators) have such a minimal impact on the markets anymore the CFTC does not even include them in the new style report.? Today the Commercial traders have their own category with no distortions.? The Commercials are now all alone under Producer/Merchant/Processor/User. Swap Dealers now have their own category as well.? If you add up all of the net long/short positions for the Producer/Processors and the Swap Dealers in the Disaggregated report you will have the same net number as the Commercial category does in the Legacy report ? much more transparency now for tracking the smart money Commercial traders.? One of the problems with using the Disaggregated report now is there is a lack of long term history to compare extremes of net positions to as there are in the Legacy reports going back to 1962.? My feeling is we need a couple of more years data points to get really good value from this newer report.? I for one will enjoy getting the Commercial only information when that time comes.

Managed Money and Other Reportables have taken the place of Non-Commercial (Large Speculators).?? Managed Money is usually traded by a money manager like a Commodity Trading Advisor (CTA), Commodity Pool Operator (CPO) or a Hedge Fund.? These managers have millions and billions of dollars under management and tend to be trend following by nature.? Other reportable traders are larger traders that trade for their own accounts, but must report their position size because of reportable position rules.

In my next article I will go over how we use the COT reports to help enhance our trading.? In the mean time you should now know the difference between the Legacy and the Disaggregated COT reports that are released each week.? The data released each week from the CFTC is difficult to follow by just reading these reports.? What we will do is look at this same data using historical information to create a longer term picture of what these market participants are doing and what they might do in the near future.

?If you?re not part of the solution, you?re part of the problem? ?

?Don Dawson