Web 2.0 Coming To A Head?

Today’s Spotlight Market

Technology stocks have faced selling pressure in the recent weeks, as market sentiment for the sector seems to have shifted. NASDAQ stocks have outperformed the broad market and many traders believe the tech sector may be long overdue for a significant correction.? Web 2.0 companies, such as Twitter, Facebook and Netflix, are priced extremely high. Traders are concerned that the valuations of many of these companies may be out of touch with reality, similar to the tech bubble that burst in 2000.? There are many similarities between then and now, including an oversaturation of companies that offer almost identical products.? This redundancy has investors concerned about the viability of some companies over the long haul.

Fundamentals

Tech has weighed down the overall market for over a month now, but it is not the only negative force impacting the market.? The standoff between Russia and the Ukraine has also cast a cloud over equities.? Traders are concerned that a prolonged standoff may result in further economic sanctions against Russia.? Threats that Russia could cut off natural gas supplies to Europe through the Ukraine are also worrisome.? March retail sales were better than expected at 1.1 %, up from 0.7 % in February.? The rise in retail sales is encouraging for reasons other than the obvious.? There is been much chatter than the less than stellar economic numbers over recent months can be attributed to the weather.? Traders are hopeful that the jump in March retails sales could possibly be a harbinger of better economic data to come.

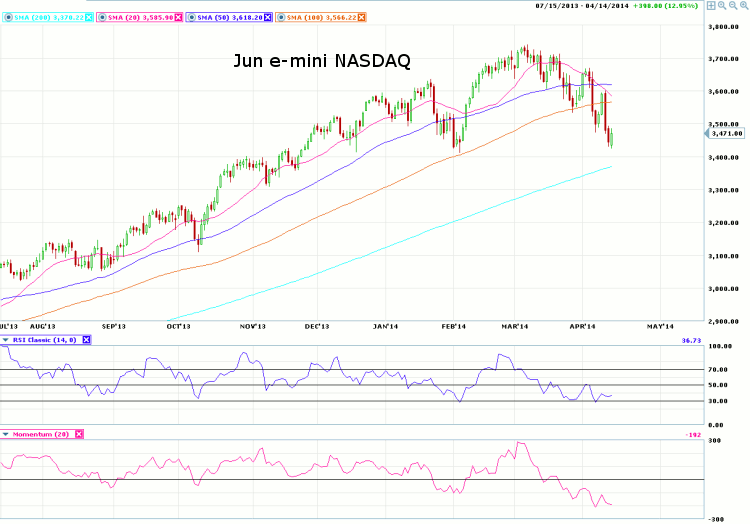

Technical Notes? -? View Today’s Chart

Turning to the chart, we see the March e-mini NASDAQ contract coming down to test relative lows at 3430.? This relative low could be seen as support and failure to hold the average could result in heavier selling pressure.? Prices are now trading below the 20-, 50- and 100-day moving averages, which could be seen as bearish.

———————————————————————————————-

Disclaimers

This article is provided for informational purposes only. No statement in this article should be construed as a recommendation to buy or sell a security or to provide investment advice. The content provided has been obtained from sources deemed reliable but is not guaranteed as to accuracy and completeness. optionsXpress makes every effort to provide timely information to its recipients but cannot guarantee specific delivery times due to factors beyond our control.

Derivatives involve substantial risk and are not appropriate for all investors. Please read the?“Disclosure Statement for Futures and Options”?prior to investing in futures or options.

For investments using a straddle or strangle options strategy the potential loss is unlimited. Multi-leg option strategies are subject to multiple commissions. Profits may be eroded by the commission expended to open and close the positions and?other risks?apply.