No ?Pop? For Corn Prices So Far This Summer

Today’s Spotlight Market

While it does appear we are in for a record U.S. Corn harvest this fall, lower Corn prices may spur increased demand — not just by U.S. livestock producers, but export sales could also increase sharply. This will be necessary to help absorb what likely will be huge U.S. stockpiles next year. The USDA is currently estimating Sept. 1st 2015 Corn inventories at 1.801 billion bushels, vs. an estimated 1.246 billion bushels for the 2013-14 season. While global Corn supply is expected to rise to 188.05 million metric tons for the 2014-15 season, the question remains whether major Corn consumers such as China may wish to take advantage of the recent price decline to help to bolster state-owned reserves.

Fundamentals

You could not ask for any better weather if you are a Corn or Soybean producer in the U.S., as ample moisture coupled with moderate summer temperatures has set the stage for a potential record harvest this fall. The downside to record production is, of course, lower prices, and that has certainly been the case for Corn futures, as prices have fallen to levels not seen in nearly 4 years, with front-month contracts now sporting a 3-dollar handle. Some analysts have sharply raised their estimates for average Corn yields to over 170 bushels per acre, which is currently well above the USDA forecast for 165.3 bushels per acre. If private forecasts are accurate, this would be an all-time high average yield.

Crop development is ahead of schedule, and conditions are excellent, with the USDA reporting 76% of the crop rated good to excellent, vs. the 10-year average of 63%. U.S. Corn exports are running near USDA forecasts, although this past week?s inspections were slightly below projections. U.S. producers holding old-crop Corn appear to be waiting for a near-term rally to unload inventory, which would be bearish for Corn prices, as any rally attempts in the near-term futures would be met with cash market selling pressure. Large speculators continue to hold a rather large net-long position in Corn futures — net-long 168,296 contracts as of the most recent Commitment of Traders report, despite the large downward move in prices. This could trigger further selling pressure in the market if these large traders finally give up on their positions should the trend continue against them.?? ?

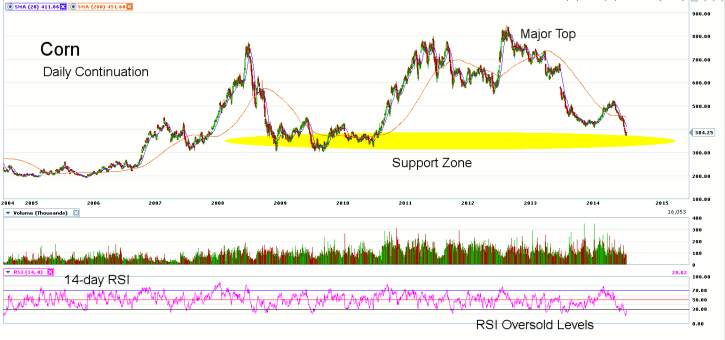

Technical Notes? -? View Today’s Chart

Looking at the daily continuation chart for Corn futures, we note that the downtrend in Corn prices actually began back in 2012, after prices peaked following the devastating drought that plagued vast swaths of the U.S. that summer.? Although prices are currently hovering near 4-year lows, we should note that the recent price floor for Corn prices is closer to the $3 per bushel seen back in 2009. This leaves the possibility for further downside price movement, especially if large speculators continue to unwind their net long positions. However, in the near-term, prices appear to be oversold, with the 14-day RSI currently reading a much oversold 20.99.? 362.00 is now seen as the next major support level for December Corn, while resistance is seen at 409.00.??

—————————————————————————————————-

Disclaimers

This article is provided for informational purposes only. No statement in this article should be construed as a recommendation to buy or sell a security or to provide investment advice. The content provided has been obtained from sources deemed reliable but is not guaranteed as to accuracy and completeness. optionsXpress makes every effort to provide timely information to its recipients but cannot guarantee specific delivery times due to factors beyond our control.

Derivatives involve substantial risk and are not appropriate for all investors. Please read the?“Disclosure Statement for Futures and Options”?prior to investing in futures or options.

For investments using a straddle or strangle options strategy the potential loss is unlimited. Multi-leg option strategies are subject to multiple commissions. Profits may be eroded by the commission expended to open and close the positions and?other risks?apply.