Tension Enough To Lift Gold?

Today’s Spotlight Market? -? TGold prices are holding steady for the second consecutive session after a rocky start to the week. Gold is finding continued support from the Russian/Ukraine conflict. The West is attempting to put some more pressure on Russia to not meddle in Ukrainian affairs by putting sanctions on Russian energy firms, defense contractors and banks. Gold is finding outside support from Palladium. South African labor unrest had cut production there and Russia had halted selling of the metal from government stockpiles. Exports of Palladium increased by 29 percent in May and a good chunk of those exports were to Switzerland, where Russia refines and stores the metal.

Fundamentals? – ? While the geopolitical climate can be seen as supportive for metal prices, recent statements from the Fed have hardly been bullish. Fed Chairwoman Janet Yellen had indicated that the central bank was prepared to raise interest rates at the first sign of inflation, even if the economy was in needed. Whether this was lip service or if the Fed plans to follow through remains to be seen. Has the Federal Reserve finally come to the realization that tackling inflation was more important than showing “economic gains” on paper??? Yellen?s predecessor certainly did not grasp this concept, leading to a largely lost decade due to commodity appreciation.? If the Fed shows it is serious in tackling inflation, it would be negative for Gold prices. There is a good amount of Fed ineptitude premium priced into Gold at the moment, which could quickly dissipate if the Fed fails to make the same missteps.

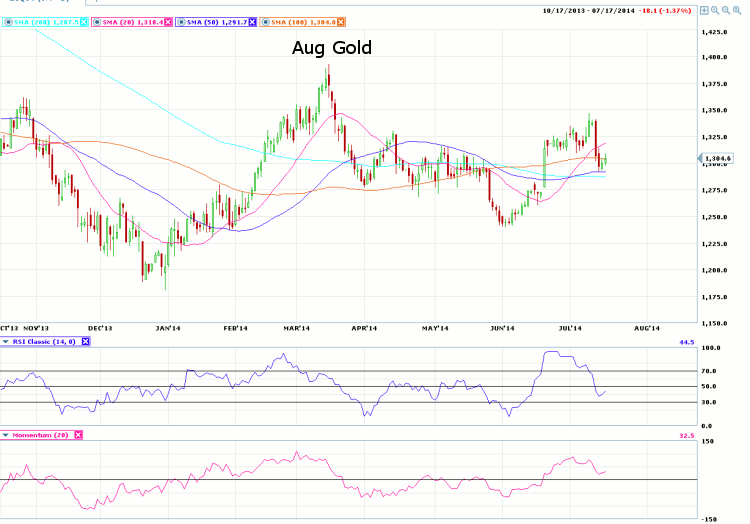

Technical Notes? -? View Today’s Chart

Turning to the chart, we see the August Gold contract failing to make a serious run at the 1350 level, sharply falling back into the trading range the market saw in April and May.? This can, at least partially, attributed to overbought levels on the RSI indicator.? The RSI was already beginning to fall prior to the? Monday-Tuesday sell-off and the indicator now finds itself flirting with over sold territory.

————————————————————————————————-

Disclaimers

This article is provided for informational purposes only. No statement in this article should be construed as a recommendation to buy or sell a security or to provide investment advice. The content provided has been obtained from sources deemed reliable but is not guaranteed as to accuracy and completeness. optionsXpress makes every effort to provide timely information to its recipients but cannot guarantee specific delivery times due to factors beyond our control.

Derivatives involve substantial risk and are not appropriate for all investors. Please read the?“Disclosure Statement for Futures and Options”?prior to investing in futures or options.

For investments using a straddle or strangle options strategy the potential loss is unlimited. Multi-leg option strategies are subject to multiple commissions. Profits may be eroded by the commission expended to open and close the positions and?other risks?apply.