The weather has been ideal in the Midwest and I can attest as I am a Chicago resident, but more importantly in corn and soybean producing areas domestically the farmers have had ideal temperature and precipitation. This has allowed farmers into the fields and a major contributing factor on why we should have bumper crops and extremely high yields. Hence the massive drop with corn and soybean prices falling off a cliff in recent months; new crop corn is lower by almost 25% and soybeans have dropped better than 15% in the last 3 months.

Corn appears to be finding mild support in the December contract near $3.80/bushel this week but until prices retake the 9 day MA (green line) we are grasping at straws. My opinion is prices have reached a value zone near current trade and we do experience ??a bounce from oversold levels. I am anticipating futures trade higher and fill the gap from 7/3 near $4.15 with my second objective being the 38.2% Fibonacci level just above $4.30/bushel. ?

On the supply side bearish weather still exists into pollination and the talk of higher yield has the bears in the driver?s seat for now. Pollination is approximately 50% complete with much of the last few weeks delivering below normal overnight temperatures and perfect precipitation levels. My concern is that if we do get a weather hiccup moving forward the weather premium has been stripped out of this complex altogether so it does not seem unreasonable to build back in a 25-40 cent weather premium. In terms of demand at this point it is just talk but the wildcards are the slackening demand for ethanol and feed usage is seen dropping as well. ?As the US market rebuilds its livestock herd corn usage will return but this is a timely process and will not have an immediate impact.

Soybean futures have traded higher the last three consecutive sessions and as of this post are violating the 9 day MA (green line). Like corn I believe the gap from 7/3 should be filled near $11.32 and I have a second objective at the 38.2% Fibonacci level that comes in at $11.47 in the November contract. Stochastics are extremely oversold and on a settlement above the aforementioned pivot point I would expect bearish trades to let go of bearish trades and accentuate a move higher.

Weather for soybeans domestically is bearish at the moment with cooler temperatures forecast this week and a slight warm up into next week but nothing outlandish. Looking to our neighbors in South America acreage is expected to rise a few % points in light of corn prices being currently below the cost of production. It?s quite staggering how we can go from such a tight balance sheet for old crop and an abundant supply year over year. I believe what the market is discounting is demand that appears to be emerging internationally with prices near current levels. There are a lot of producers looking to sell so I do not think a large appreciation is sustainable but like corn I do think a bounce in the cards.

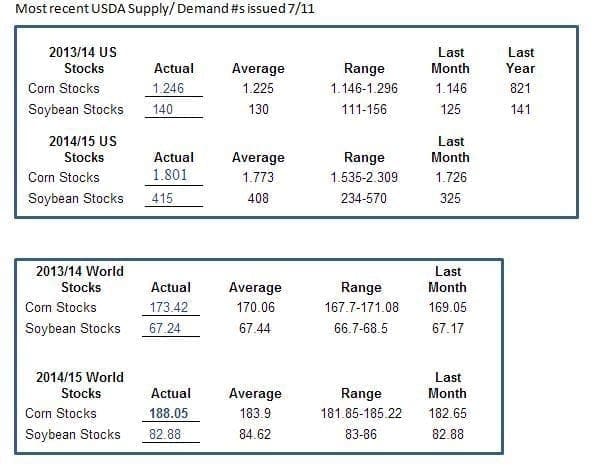

I also wanted to shed light on the most recent USDA figures (see below).? Both corn and soybeans stocks domestically and globally came in on the higher end for both this crop and next year?s crop.?

I am not forecasting this to be the ultimate end to the bearish market in Agriculture but I do think we have an opportunity to play a bounce as the ship is leaning too far one way in my eyes.??

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (?Forex?) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.