A topic that is consuming the Pro Chat group at Option Pit has been the relative stickiness of the VXX lately. ?There was finally a break in the product over the past few days, but for the most part VXX has decayed much less than expected so far this year. ?I won’t trouble you with the whys, but much has to do with how the VIX futures are acting. They just don’t decay like they used to.

The exception to the funky decay profile might be yesterday. ?With a .28 rising in VIX cash, the VIX futures actually declined a bit. ?The stranger thing is that they declined into the NFP number released earlier today. ?One of the most reliable vol. trades has been the jump and then decline of the VIX futures going into the NFP over the last year, and for some reason we did not get that yesterday.

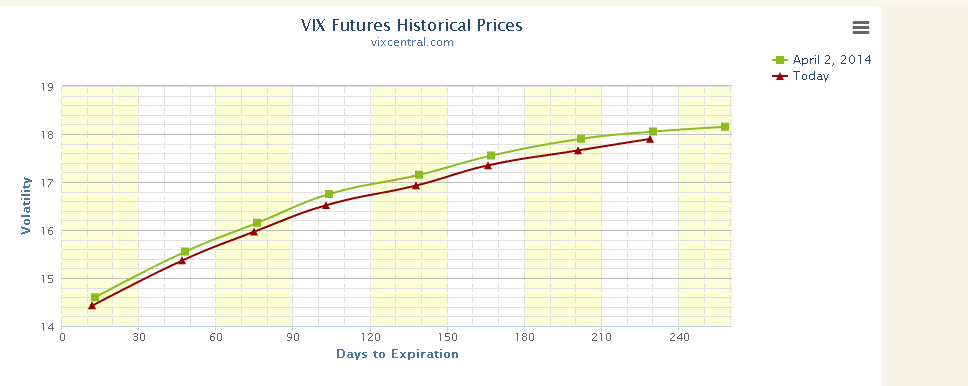

What we got was a compression, as you can see from the VIX Central curve of VIX futures. ?On a day where there should be a bid for uncertainty, the future traders took a step and sold VIX futures down. ?This could signal a volatiltiy dump tomorrow if they are right. ?They usually are.

The Trade

I would day trade the VXX or UVXY puts for a buy on the open to a sell on the close tomorrow. ?If the number is even halfway decent we might see a good size markdown in these products as the VIX futures lose more premium. ?We have a similar position in our Strategy Letter.

Disclosure: positions in VXX