I will be traveling to London next week and when I was thinking about the trip, a thought came to mind. A while back, a few friends and I were eating at The White Horse, a small, cozy restaurant in the little village of Welwyn England. This establishment is over four hundred years old. The food was great and we sat right next to a burning and crackling fireplace that had been in use since the restaurant opened. This was a real four hundred year old fireplace with real logs; I felt like I was in an old movie. Using a metal stick to maneuver the burning logs and an old Bellow to help the flames breath, people would walk over and tend to the fire every once in a while. The food was good, the conversation was great, but I could not stop thinking about that fireplace. You see, I am always attracted to genuine, original, and real things in life. After a glass of wine and some hot Camembert, it hit me, the fireplace reminded me of trading?

The biggest challenge I see new traders face in their journey towards consistent low risk profits is the ability to keep things simple and real. Instead of seeking quality education and information, the majority of aspiring traders seek quantity of information. Instead of keeping the process simple, they complicate things with more tools, more rules, and a library of indicators that could fill up a daily chart on the jumbo tron at Wembley. Some new traders that I meet in the Extended Learning Track or classroom talk to me about so many trading ideas sometimes that I feel like I am the one getting the lesson and I don?t even understand it.

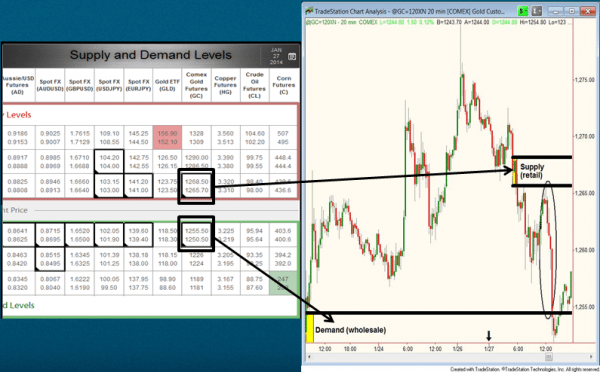

The chart below is a chart of Gold, a setup provided by the Mastermind Community Supply/Demand grid. Supply and demand levels are marked on the chart. This was demand (support) because price rallied strong from this level. It could not stay their because there was much more willing demand than supply at that price level, this is the ONLY reason for the rally in price. If that statement was not true, price would never have left the level, it would have stayed at that price. The Supply zone is also supply for the very same reasons, price could not stay at that level and declined. Shortly after the Supply / Demand grid gave those levels, price revisited the supply zone and it was time to sell. This means that buyers were buying after a rally in price and into an objective supply level. Only a novice trader would take that action. Our action was to simply sell to that novice trader as I have written about so many times. The risk was as low as it could be, reward as high as it could be, and the probability of price turning lowerer was VERY strong. I would write more about this but there is really nothing else to say. This is motion into mass, supply and demand, whatever you want to call it? Why complicate something if you don?t have to?

Mastermind Community Supply/Demand Grid: Gold Futures

We are people and people in general have the hardest time keeping things simple. In all parts of life, things tend to get complicated. When there is an issue, the tendency is to dive deeper into the problem to resolve the issue. In trading, this action will quickly drain your account and deposit it right into someone else?s.

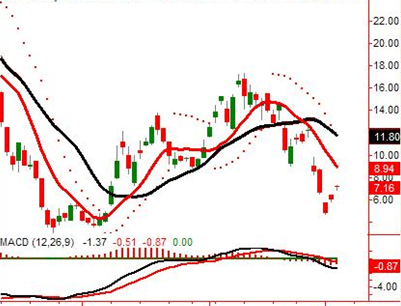

The next chart below is a chart I see all too often. It is loaded with indicators and oscillators that almost cover up the price action completely. People add these tools because they think the tools add some edge and reduce some risk. What they don?t realize is that these tools may actually be doing two things that very much work against the trader. First, they lag price which means adding risk to your trading if you use them as a primary decision making tool. Notice the direction of the moving averages, when price is low and at demand and it?s time to buy, the averages are still pointing down, ensuring you will not buy. Using these tools in a conventional sense ENSURES you will never attain the low risk entry and instead, ENSURES that you will ignore it. There is a very right way to use them but most traders choose to use them in conventional ways. Second, by overloading our brains with too much useless and conflicting information to process, something as simple as buying at demand becomes nearly impossible.

Last time in London, a student asked me what the difference was between a Slow Stochastic and a Fast Stochastic oscillator. I replied, ?Whe word before Stochastic.? My point was this? The student is going down the wrong path if he or she is going to make a derivative of price a primary decision making tool. Once they try the slow and the fast and don?t see positive results, they will try the middle, the very fast, and the Super Duper Speedy Speed Racer Fast Stochastic? I think you get the point. They are taking route 66 trying to reach Miami Beach and don?t even know it because the path they are on is an illusion. It?s all an illusion that actually forces you to ignore reality. This trap is one of the many vehicles the market uses to transfer accounts from those who ignore reality, into the accounts of those who don?t.

High speed connections, super computers, automated strategies with 7 billion inputs, and a few hundred new indicators have created this illusion that you can somehow ignore the simple reality of how markets really work. Markets don?t change, motion into mass is no different now than when Isaac Newton talked about it long ago.

These days, most fire places are gas burning with fake logs, some added chemicals for color, and an on/off switch that is likely tied to your Ipad. This fireplace will certainly heat up a room but for me, only in temperature.

The old fire place in Welwyn still burns the same way it did four hundred years ago?

Hope this was helpful, have a good day.

Sam Seiden?