A student emailed me?and asked about the usefulness of the market depth window on his trading platform.? As a former scalper, I am intimately familiar with that tool and how to read it.? You will notice that I said a former scalper.? I now focus on short term trading based on charts and do not use the market depth in my own trading.

If you are not familiar with scalping, it is a trading style that attempts to profit from very small movements in price or simply?capturing the spread of a stock by buying on the bid price and selling on the ask price.? I did this in America in the beginning of my trading career and made good money at it.? In India, this style of trading is called jobbing and is prohibitive due to the commission costs.

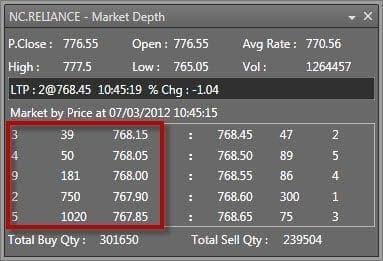

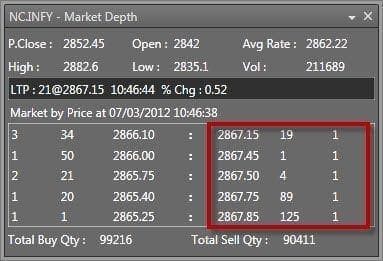

That is not to say that the market depth is useless.? This window gives you some valuable information as to the immediate supply and demand picture of the security you are looking at.?? The Bid is where passive buyers can post their orders to buy shares.? I call them passive because they are stating the maximum price they are willing to pay and must wait for someone to sell to them?at that price or better.? The number of shares shown on the bid is the immediate demand in the stock.

The Ask or Offer is where passive sellers place orders to sell their shares at a particular price or higher.? Once again they are passive orders as these sellers must wait for someone to buy from them.? Their shares represent the immediate supply in the stock.

There is a problem with blindly assuming that the market depth is the true supply and demand scenario.? All participants in the market can elect to show only a portion of their true order.? For instance, if I wanted to buy a large quantity of shares, I could post on the bid.? But as soon as my large number for shares to buy showed on the bid, other buyers would buy in front of me due to the large demand.? That would cause the prices to rise and I would either not get filled or would have to accept a much higher price for my shares.

To avoid this and to get a good price for my shares, I have the choice to disclose only a portion of my order to the market.? I must show a minimum of 10% of the complete order as does anyone.

When you are deciding whether to enter a long or exit a short at a demand zone, large buying pressure stacking on the bid may help your decision.? However, if there is still large selling pressure on the offer you may want to hold on to a winning short or postpone a long entry.

The same process can be used at a supply zone to see if price is more likely to continue or to reverse.? If you see larger numbers of shares on the bid, then price should continue to rise.? But if you see the offer showing large size then prices are more likely to reverse and drop.

Can you trade without in depth knowledge of the market depth?? Of course you can.? This is just an additional tool to assist you in your decision making at supply and demand zones.? Focus on your charts and trend and you can achieve trading success.

Brandon Wendell